BLOG

Strategy – It Becomes You

If You Don’t Know Where You Are Going, You May End Up Somewhere Else – Yogi Berra

“We have to clean up all our problems before we consider developing a strategic plan”. “We are already successful; why mess with something which is making us money”.

ACQUISITIONS – Turn Up The Volume

“What’s In It For Me?”

Brokers respond better, faster, and more consistently to those firms which understand the phrase “What’s In It For Me” …from t he perspective of the broker!

Meaning, the brokers are all Tom Cruise, and they are asking prospective buyers every day to “Help Me To Help You”.

Grow – Better, Bigger, Beyond!

Help me to help you!

Do you want your realty portfolio/operating business to be better?

Insights on how to improve employee performance

Share secrets to reduce overhead and increase profits

Learn from real-life personal successes & failures

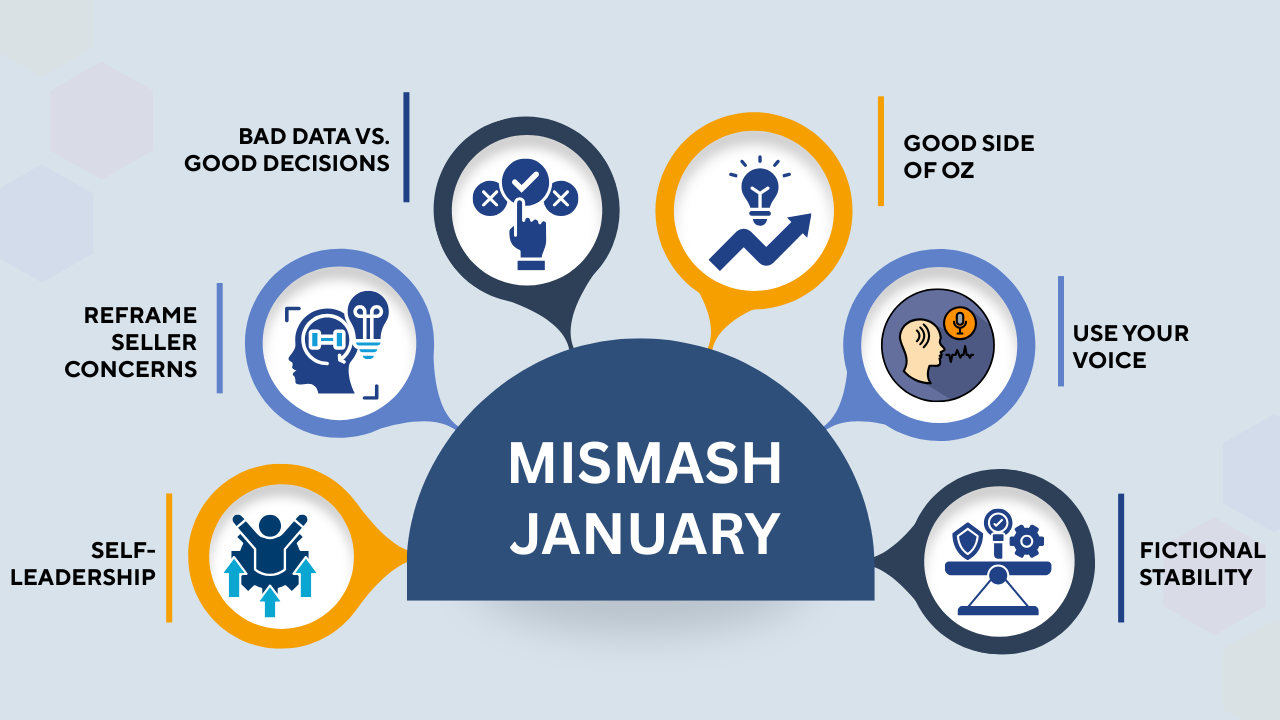

Mismash January

Things which make me go “huh?”

SELF-LEADERSHIP

We cannot outsource our attitudes, values, behavior, or willingness to improve – Dr. Mary Kelly. She goes on to focus on whether we are “self-aware” (less than 15% are), which determines if we are receptive to constructive feedback as useful information. Ask how you make people feel!

Customer Disservice!

50 Ways To Lose Business

Why do some successful businesses fail?

Process – desire for “efficiency” – overtakes substance – the consumer experience. Strategic Growth can be undermined by failure for senior leadership to remain current with the needs of their targeted consumer.

Love Letter...To Myself!

Better Than My Used To

January is like the off-season for the Dallas Cowboys – everything is possible, no matter the reality!

At the end of each year, for now over 55 years, I generate from what I journal daily in a written log, a “Franklin T” of what went well and where I failed to make progress.

Mish Mash – December

Best Stuff In My Files!

Hope your year is ending up well!

It has been a great year helping with client “strategic growth” challenges and opportunities. “Transact, Transform, and Transition” has served well as my game plan for their success.

Buckle up, though, for 2026; it is going to be a WILD ride!

Rehab, Restore, Rebuild…Relax?

Pick your lane for 2026

Look at our business, our portfolio, and ourselves.

What lane is best for us to travel in 2026?

“ONE SIZE” does not fit all. To grow, we need to select a specific lane appropriate for each aspect of our business, portfolio, and self.

The “…all things to all people all of the time tends to result in being nothing to nobody…”

2026 Preparations

Do You Know Where You Are Going To?

At the end of each year, I prepare two documents for only my review –

What went well, and what did not?

Where am I heading in the new year, and why?

This is a process I have performed for over fifty (50) years. The self-assessment can be brutal, as there is no one else to blame for what I did or didn’t do!

Lies, Damn Lies …and Realty!

LIES, DAMN LIES …AND REALTY!

What is behind the story?

What is worse – an outright lie or a half truth?

An outright lie can be verified, and the liar can be (eventually) exposed…or elected to higher office!

Buy Old, Create Young

EVERYTHING OLD…IS STILL OLD

Development is a great play for those who can handle multiple years of no cash flow and the real risk of 100% loss of their investment. Opportunity Zone investing helps lower capital gains taxes…but there needs to be dramatic success to ever get to that “lovely problem”!

Mish Mash – November

Good Short Insights

WHY BRING IN AN ‘EXPERT” WHEN YOU ALREADY KNOW EVERYTHING?

Sometimes an outside expert provides a fresh set of eyes. Sometimes, they just reflect to you what you already know. In theory, they will provide an unbiased assessment of your situation.

Las Vegas Reflections

IT DOESN’T ALL STAY

What happens in Las Vegas may well stay in Las Vegas. But lessons learned linger for a long time. Hope you find something interesting from my visits to Sin City.

NON TRADED SECURITIES

ADISA is the “Alternative & Direct Investment Securities Association”. I am a prior President of the group (2010 – 2011).

Mish Mash

Half Thoughts and Lost in Files

My “clean out the files” days result in my favorite REALTY REALITY articles! None alone are going to move the needle; all deserve to see the light of day.

SENIOR HEALTH CARE FACILITIES. In 1985, a major national consulting firm affiliate of a major CPA firm project OUTRAGEOUS growth in the demand for Adult Congregate Care facilities.

2026 Real Property - Forecast

Every day a new reality!

Exploring the direction for real property in 2026 requires a nuanced examination of conflicting trends.

As with political rhetoric screaming from every direction, be prepared for the same in real property.

Pundits will say, “best time ever to invest” and “the end of the real property world as we know it”!

Pick Your Lane

Say Yes to One, and Leave the Other Behind

All things to all people, leaves you with being nothing to nobody.

A Wall Street real estate firm decides to sponsor energy securities. Are they now just a huckster of offerings?

A broker of HVAC firms decides to sell a pizza store. Have they become desperate for business, and now take whatever walks in the door?

BEST ENTRY LEVEL HIRE?

Hire slow; fire fast!

How do we hire the best person for an entry level investment real estate position?

With a “green pea” hire, what they can become is far more important than what they can accomplish on day one.

The habits they bring in will be what you spend most of your time either overcoming, or in a few special situations, enhancing.

GROW 2 EXIT!

Cycle of Success

“It’s not what you make; it is what you keep”.

Without “making it”, though, there is nothing available to keep!

What then are the critical steps to growing…and what do we need be doing to prepare for exit?

Consider where you are in the T6 CYCLE (aka the “business circle of life”!)—

TREASURE.

Aggregate capital to grow. Capital can be financial, human, or intellectual.

Great Recession Lessons

Everything old is new again!

Do you remember the hard lessons we learned following the 2008 collapse of the economy and the long multi-year slog following?

Our best hope is that the 9 – 12 months ahead will move quickly, each month covering what took years following 2008. There were (on average) 200,000 new jobs created per month; 100,000 in 2024.

Deadly Life Lessons

HALLOWEEN REFLECTIONS

Our readers universally tell us they learn more from well executed failures than from lucky successes.

What are your “deadly life lessons” which haunt you as we start preparing for Halloween?

Please share you “best of” failures for inclusion in a future editions of REALTY REALITY.